Customer Segmentation in Bank of XYZ Using Data Mining Technique

Arta M. Sundjaja

Universitas Bina Nusantara

ABSTRACT

Competitiveness in the banking industry has made the task of raising third party funds becomes more difficult because of customer needs have become more complex. This paper discusses the use of demographic segmentation in defining customer needs, customer profile, preferred transaction and channel from each segment using data mining techniques. Unstructured interviews conducted with the management team and Data warehouse department in the head office of a big private bank in Indonesia. Data were collected from the data warehouse and analyzed using Microsoft Excel. Although there are more advanced segmentation techniques available, this research used demographic segmentation to find insight of the product and services already offered to existing customers. The findings were further interpreted to refine the products and service development and also improve the marketing promotion.

Keywords: data mining, demographic segmentation, customer profile and behavior.

Introduction

In the highly competitive market of the banking industry, it has become difficult for each player to compete in the market for a long-term period with the same products/services. Thus development of a suitable marketing strategy over time is required.

Right marketing strategies will helps companies to achieve marketing and corporate objectives which in turn will create a competitive advantages in the market (Goyat, 2011). The market segmentation concept was introduced in the middle of 1950 by Wendell R. Smith, an American Professor of Marketing. Market segmentation helps bank identify customer needs, preferences and find new marketing opportunities. A segment should be grouped with measurable attributes. While demographic factors are easy to identify and measure, this is not the case with psychographic variables such as motivation and lifestyle, which are difficult to identify and even measure (Mawoli, 2012). The result of this segmentation exercise is an insight into customer behavior which will be further developed into a marketing strategy to better meet customer needs.

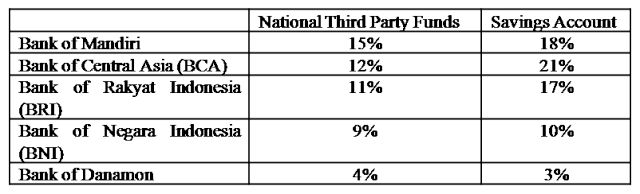

Based on data from Bank Indonesia as of October 2008, third party funds that have been collected amounted to Rp 1.697 T which is 11% raised than the previous year. Market share of the third party funds and savings account from 5 biggest national banks are shown in Table 1. Based on the data below it can be concluded that raising third party funds is highly competitive since not a single bank could meet all customer needs and demands.

Table 1. Comparison of 5 largest Indonesian banks per October 2008

Recent developments of information and communication technologies (ICT) has helped modern banks in responding to many challenges such as process automation, customer changing demand, new product development and so forth. With process automation, bank recorded large amount of data daily and their data warehouse record all client information that includes personal, psycho-social, property and financial information (account information, transaction per account, credit liabilities, etc). The Board of Management is required to make a timely and effective decision based on accurate and reliable information deriving from this data. Business intelligence (BI) solutions for banks should provide decision makers with the ability to manage and exploit information resources. This ability would be used to solve the problems and make timely and high-quality decisions. Common applications of BI are Customer Relationship Management (CRM), Performance Management (PM), Risk Management (RM), Asset and Liability Management (ALM), and Compliance (Ubiparipovic & Durkovic, 2011). Services and trading companies expressed a higher relative need for information about social trends, customer demographics, the analysis of sales data, and lifestyle to help them understand their customer. In different business areas, especially focused functions (sales and marketing) expressed a relatively high need for information on the market environment especially customers (customer demographic and lifestyle) (Venter & Tustin, 2009).

Objectives of this research includes: a) identification of customer characteristics based on their job profile, b) identification of customer behavior (current balance in savings account for each segments drilled down by customer profile (age tier, gender, balance tier, and education background), transaction behavior, and channel used.

The research explored practical investigation to find an insight of products and services offered to the existing customer. Unstructured interviews conducted with the management team and BI department in the head office of a big private bank in Indonesia. Data were collected from the data warehouse and analyzed using Microsoft Excel. The findings were further interpreted to refine the products and service development and improve marketing promotion.

Literature Review

Segmentation

Market segmentation is classification of the customers who have similar needs, characteristics, and behaviors (Dibb, 1998). Market segmentation is a process of dividing a market into different group of customer with similar needs or characteristic and selecting one or more segments to target with a distinct marketing mix (Mawoli, 2012). It is very important to define groups which is significantly different from each other (Sun, 2009).

Customer can segmented on the following customer characteristics, such as geographic, demographic, psychographic, and behavioral (Mawoli, 2012); (Kottler & Keller, 2006). Geographic segmentation divides a broad market into geographic units such as continents, nations, region, cities. The philosophy behind geographic segmentation is that people who live in the same area are bound to share similar culture and experience the same experience which makes them to acquire similar needs (Schiffman & Kanuk, 2000); (Kottler & Keller, 2006). Demographic segmentation is the process of grouping a customer market using demographic variables such as age, sex, marital status, family type/size, family life cycle, occupation, etc (Schiffman & Kanuk, 2000); (Kottler & Keller, 2006). psychological segmentation is the process of grouping a customer market using psychological variable such as motivation, life-style, attitude, perception, and personalities (Schiffman & Kanuk, 2000); (Kottler & Keller, 2006). Behavioral segmentation is the process of grouping a customer market using behavioral variables such as knowledge, attitude, uses, and responses (Schiffman & Kanuk, 2000); (Kottler & Keller, 2006).

Business Intelligence

Business intelligence introduced by Howard Drenser (Gartner Group) in the 1989, to describe a set of concepts and methods to improve business decision-making by using fact-based and computerized support system (Farrokhi & Pokoradi, 2012). According to (Chaudhuri, Dayal, & Narasayya, 2011), Business Intelligence software is a collection of decision support technologies for enterprise aimed enabling knowledge worker (executives, managers, and analyst) to make better and faster decisions. The architecture of a bank’s business intelligence system consist of operational database and external data, the data integration and transformation layers, the data warehouse layer, the data access layer and the front end (Ubiparipovic & Durkovic, 2011). Operational database created to support the need of daily operation, Online Transaction Processing (OLTP) is the bank’s basic information system. The data integration and transformation layers contain processes of transforming operational and external data into a data warehouse. The data warehouse is an analytical database used as the basis for BI system. Data warehouse designed to store large amounts of data in the simple and efficient way to create information required in the decision-making process. The data access layers contain Online Analytical Processing (OLAP) and data mining activities. Users (analyst, manager, etc) use OLAP to get insight from the data gathered from data warehouse in quick, consistent and interactive way. Data mining is the process of exploring and analyzing meaningful stacks and rules. Data mining uses statistic techniques and artificial intelligence algorithms to find significant hidden stacks in large data sets. The front end application that used by the users already developed and tend to become increasingly sophisticated and offer many opportunities for manipulating, analyzing, and presenting the information. Common practice for accessing and presenting the information is reports for answering common business problem, complex queries to answer ad-hoc business problem, scorecard tables for visual monitoring of Key Performance Indicator (KPI), dashboards that integrated all information required for decision-making in one place (Ubiparipovic & Durkovic, 2011).

Discussion

In developing market segmentation, Bank of XYZ used demographic segmentation technique based on customer profession. Data collection techniques are conducted by using data mining method in the company database. The location of the data is in the head office. Segmentation processes conducted by the product owner are as follows:

- Market identification.

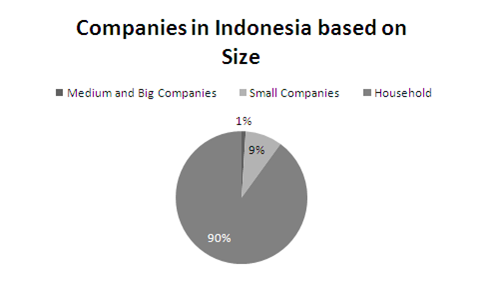

The first phase of customer segmentation is management defined the potential market in Indonesia to help which segmentation method suitable with bank strategies. The data collected from Badan Pusat Statistik (BPS) in February 2007, Indonesia’s total population is 240 million and the total company in Indonesia is 2,7 million.

Figure 1. Mapping of Population and Companies in Indonesia.

Based on the data, it can conclude that worker and labor dominated almost 87% of total Indonesia population and only 12% chose to become entrepreneur. Meanwhile, 90% of companies in Indonesia are household industry and only 10% is small-medium enterprise and large companies.

- Identify potential needs of customers.

After knowing the potential customer through data from BPS, the management identifies the needs of each customer segment. After customer needs identification finished, the management can evaluate the available product in the market and create new product to fulfill the unidentified needs of the customer.

Business and corporate customer needs has some similarities where the difference is a form of ownership. The needs of individual and corporate customer are as follows: receive income from sales and purchase inventory in cash or credit from domestic and or foreign, purchase equipment and supplies to support operation activities, invests using debt or equity, and managing financial operation.

The needs of employees are receiving income from company, manage finance for personal and or family needs.

The needs of housewife are receiving a portion of the husband’s income, manage finance for personal and or family needs.

The needs of student are receiving a portion of the parents, manage finance for personal needs.

- Segmenting.

Based on customer needs identification, management analyzes customer profiles by using data mining to define the market.

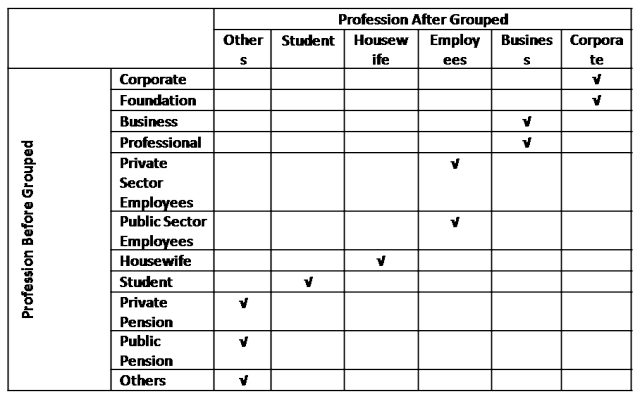

Table 1. Profession Obtained from Data Mining Process

Before management defined the customer segment, the IT Division provided detailed customer profession mapping for grouping similar nature of profession into 1 customer segment.

Figure 2. Customer Mapping Based on Profession.

Based on result of data mining that conducted by IT Division, management divide customers into 6 segments that is corporate, business, employees, housewife, student and others.

- Evaluation of customer segment behavior.

In evaluating the behavior of the segment, the management decided to evaluate the customer profile and transaction behavior in each segment. In evaluating customer profiles, the management uses several measurements such as the number of account opened, the balance of saving accounts, and amount of the transaction. In presenting the result of the evaluation, we modified the result with a formula ((value in cell) x (Grand Total of Grand Totals)) / ((Grand Row Total) x (Grand Column Total)) for confidentiality.

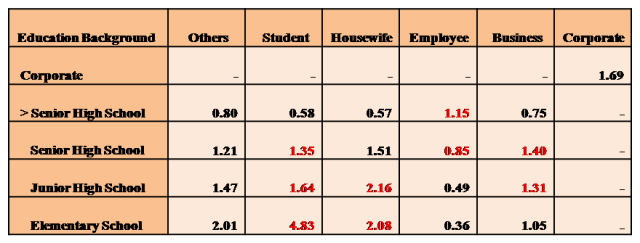

Table 2. Ratio of the Balance of Saving Accounts Based on Education Background.

Based on the analysis of data, it can conclude that the balance of saving account for business segment is customer who has a senior high school and junior high school education. The balance of saving account for employee segment is customer who has a minimum senior high school education. The balance of saving account for housewife segment is customer who has a elementary school and junior high school. The balance of saving account for the student segment is a customer who has education between elementary school and senior high school.

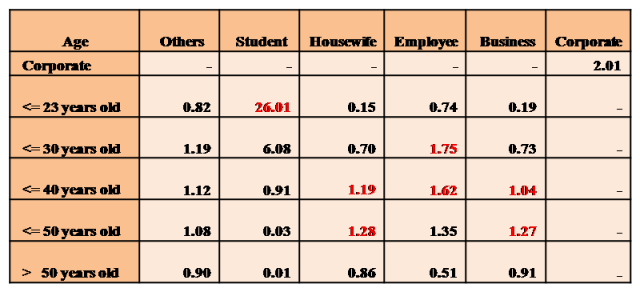

Tabel 3. Ratio of the Balance of Saving Accounts Based on Age.

Based on the analysis of data, it can conclude that majority business customer segment aged between 31-50 years old. Employee customer segment aged between 24-40 years old. Housewife customer segment aged between 31-50 years old and student customer segment mostly less than 23 years old.

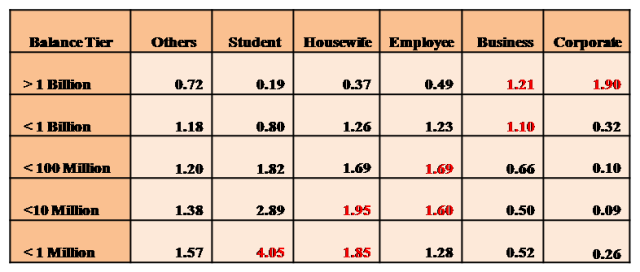

Table 4. Ratio of the Balance of Saving Accounts Based on Balance Tier.

Based on the analysis of data, it can conclude that corporate segment has over 1 Billion funds, the business customer segment has over 100 Million funds, the employee customer segment has the funds between 1-100 Million, the housewife customer segment has below 10 Million funds and the student customer segment has below 1 Million funds.

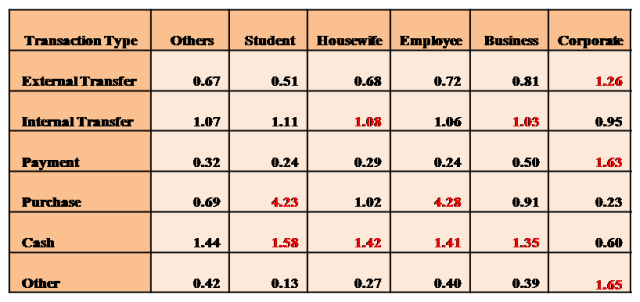

Table 5. Ratio of Incoming Transaction Amount Based on Transaction Type.

Based on the analysis of data, it can conclude that corporate segment receiving funds from external transfer, payment and others, the business customer segment receiving funds from internal transfer and cash deposits, the employee customer segment receiving funds from cash deposit and purchase, the housewife customer segment receiving funds from internal transfer and cash deposits, and student customer segment receiving funds from purchase and cash deposits.

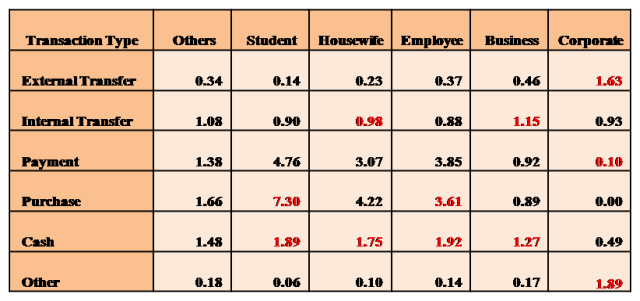

Table 6. Ratio of Outflow Transaction Amount Based on Transaction Type.

Based on the analysis of data, it can conclude that there is a similarity in transaction type between employee, housewife and student customer segment which is payment, purchase and cash withdrawal. The corporate segment uses external transfer and internal transfer for business interaction with their business partner and other transaction for loan payment. The business customer segment uses internal transfer, payment and cash withdrawal.

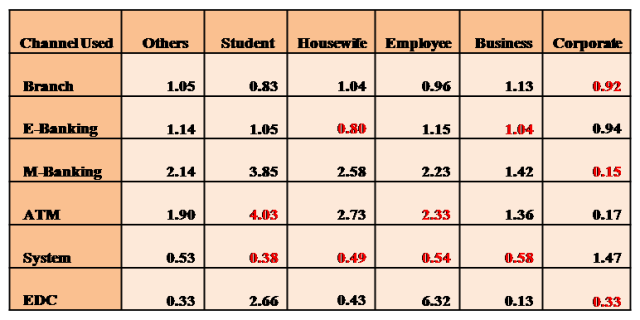

Table 7. Ratio of Incoming Transaction Amount Based on Channel.

Based on the analysis of data, it can conclude that there is a similarity between student and employee segment in term of incoming transaction channel which is they use M-Banking, ATM and EDC. The corporate segment use branch, E-Banking, and system as preferred incoming transaction channel. The business customer segment use branch, M-Banking and ATM as preferred incoming transaction channel. The housewife customer segment uses M-Banking and ATM as preferred incoming transaction channel.

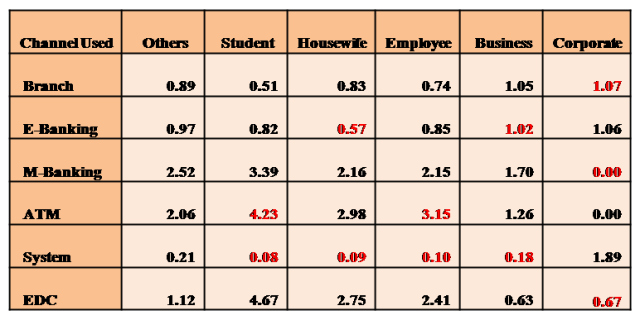

Table 8. Ratio of Outflow Transaction Amount Based on Channel

Based on the analysis of data, it can conclude that there is a similarity between student, housewife and employee segment in term of outflow transaction channel which is they use M-Banking, ATM and EDC. The corporate segment use branch, E-Banking and system as preferred outflow transaction channel. The business customer segment use branch, M-Banking and ATM as preferred outflow transaction channel.

Conclusion

This paper has identified customer profile, preferred transaction and channel of each segment. The segmentation result identified that preferred incoming transactions of corporate segment are external transfer, payment and others, while the outflows transactions of corporate segment are external transfer, internal transfer and others. Preferred channel for incoming transaction of corporate segment are branch, E-Banking, and system, while for the outflow transactions are branch, E-Banking and System. The business customer segment has an average age between 31-50 years old; their education background is mostly between junior high school and senior high school. Their average balance of saving accounts is more than 100 million. Preferred incoming transactions of business customer segment are internal transfer and cash deposit, while the outflow transactions of business customer segment are internal transfer, payment and cash withdrawal. Preferred channel for incoming transaction of business customer segment are branch, M-Banking and ATM, while for the outflow transaction are branch, M-Banking and ATM. The employee customer segment has an average age between 24-40 years old; their education background is minimum senior high school. Their average balance of saving accounts is between 1-100 million. Preferred incoming transaction of employee customer segment are payment and cash deposit, while the outflow transactions of the employee customer segment are payment, purchase and cash withdrawal. Preferred channel for incoming transaction of employee customer segment are M-Banking, ATM and EDC, while for the outflow transaction are M-Banking, ATM, and EDC. The housewife customer segment has an average age between 31-50 years old; their education background is mostly between elementary and junior high school. Their average balance of saving accounts is under 10 million. preferred incoming transaction of housewife customer segment are purchase and cash deposit, while for the outflow transaction of the housewife customer segment are payment, purchase and cash withdrawal. Preferred channel for incoming transaction of housewife customer segment are M-Banking and ATM, while for the outflow transaction are ATM and EDC. The student customer segment has an average age less than 24 years old; their education background is mostly between elementary school and senior high school. Their average balance of saving accounts is under 1 million. preferred incoming transaction of student customer segment are purchase and cash deposit, while for the outflow transaction of the student customer segment are payment, purchase and cash withdrawal. Preferred channel for incoming transaction of student customer segment are M-Banking, ATM, and EDC, while for the outflow transaction are M-Banking, ATM and EDC.

The result of this paper is an insight for the product owner so that product owner can evaluate the existing products and services based on this finding and formulate new products and services for each segment based on their needs.

Study Limitation

This paper examined Bank XYZ customer profile, transaction and channel preference by using demographic segmentation. Analysis about customer profile, transaction and channel preference is a static study which data gathered in one specific time period. The data representation in this paper is already modified for confidentiality of corporate data.

Further Research

Further research in this field is very important to be conduct. The each segment flow of fund would offer marketing insight about customer interaction with their partner, this marketing insight will be important for developing marketing strategies for Bank XYZ. It believed that customer interaction analysis will generate value for product owner how to serve their prime customer in a specific segment.

The result of this study may highlight a number of additional directions for future bank marketing research. These important future research areas may be listed as follows:

- Extend the segmentation studies in other banking product such as premium saving product, demand deposit, time deposit, etc.

- Regional segmentation studies in Bank XYZ across a number of region of Indonesia and/or comparison of national segmentation with specific region for development of effective marketing strategies.

Bibliography

Amstrong Gary, Philip Kotler. (2001). Dasar-Dasar Pemasaran. Edisi 8. Erlangga. Jakarta.

Chaudhuri, S., Dayal, U., & Narasayya, V. (2011). An Overview of Business Intelligence Technology. Communication of the ACM , 88-98.

Dibb, S. (1998). Market Segmentation: Strategies for Success. Marketing Intelligence & Planning , 394-406.

Farrokhi, V., & Pokoradi, L. (2012). The Necessities for Building a Model to Evaluate business Intelligence Projects – Literature Review. International Journal of Computer Science and Engineering Survey , 1-10.

Goyat, S. (2011). The Basis of Market Segmentation: A Critical Review of Literature. European Journal of Business and Management , 45-54.

Kottler, P., & Keller, K. (2006). Marketing Management. New Delhi: Dorling Kindersley Pvt. Ltd.

Mawoli, M. A. (2012). Effective Market Segmentatin and Viability of Islamic Banking in Negeria. Australian Journal of Business and Management Research , 1-9.

Schiffman, L., & Kanuk, L. (2000). Consumer behavior. New Jersey: Prentice Hall.

Sun, S. (2009). An Analysis on the Conditions and Methods of Marketing Segmentation. International Journal of Business and Management , 63-70.

Ubiparipovic, B., & Durkovic, E. (2011). Application of Business Intelligence in the Banking Industry. Management Information System , 23-30.

Venter, P., & Tustin, D. (2009). The Availability and Use of Competitive and Business Intelligence in South African Business Organisations. Sourthern African Business Review , 88-117.