Miniso’s Porter 5 Forces Analysis : Threat of Substitution

Introduction

Miniso is one of the biggest retail stores in the world. They sell a wide range of products, including home decor, small electronics, accessories, beauty tools, toys, cosmetics, snacks, and more. According to its annual report, in the span of only 6 months, Miniso has opened 622 new stores in 2023. And in the same 6 months, Miniso has achieved sales of approximately RMB 14.3 billion or USD 2.002 billion.

Despite its success, it doesn’t mean that Miniso doesn’t have its own challenges. Miniso also has to compete with its substitutes. Its substitutes are brands like Muji, Ikea, Daiso, Flying Tiger Copenhagen, Typo. Which has a similar business model as Miniso but they used a different market approach.

Threat of Substitution

Now, let’s dive deeper into the threat of substitution for Miniso. To understand Miniso’s threat of substitution better, let’s dissect it into different parts :

1. Price – Low threat

The substitutes of Miniso tend to have a higher price point. For example, Muji is significantly more expensive compared to Miniso. This price gap makes ‘price’ a low threat to Miniso.

- Buyer price sensitivity – Moderate threat

Miniso controls their pricing trends. According to Miniso’s global offering report, other brands have the same trends for price fluctuations as Miniso. Miniso follows a similar pricing strategy in order to keep being attractive to consumers that are seeking affordable options.

- Buyer switching cost – Low threat

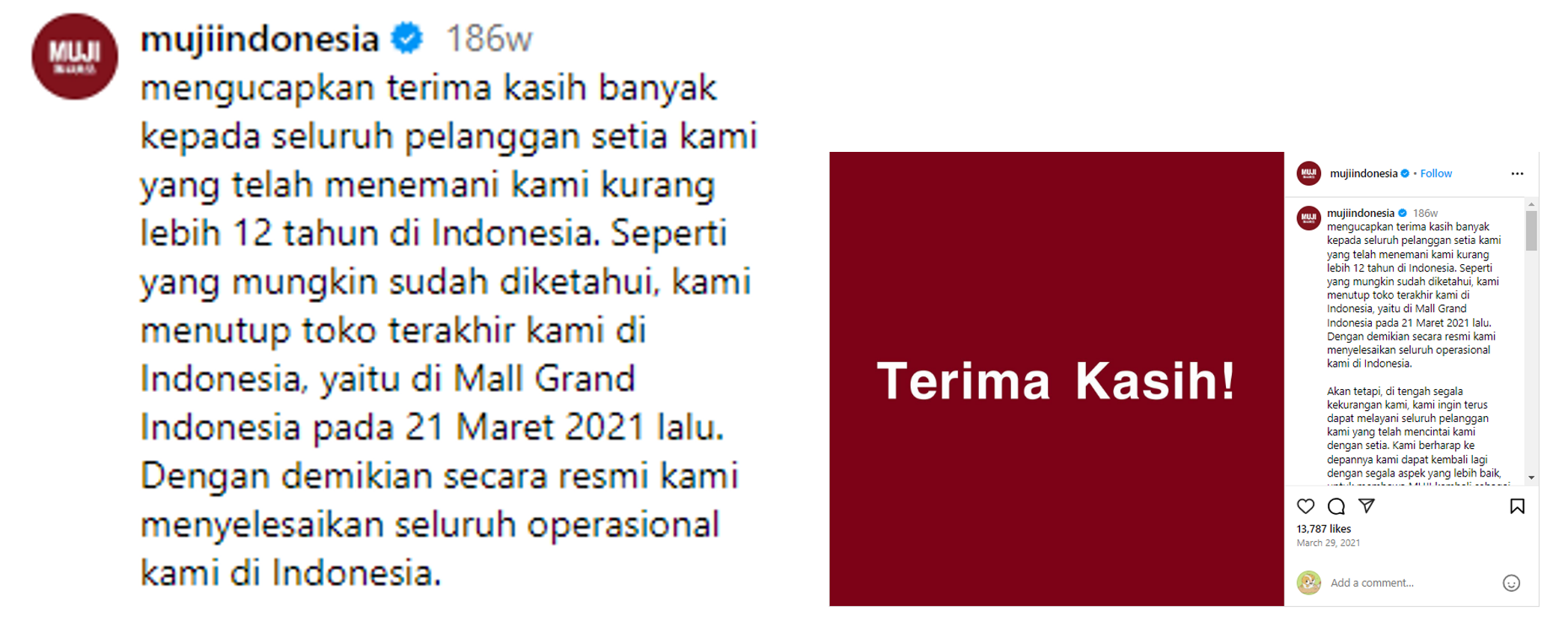

Miniso’s substitutes have a much higher price point for the same kind of products (as explained above) which makes the switching cost high. In countries like Indonesia for example, customers also have limited access to Muji stores. Because, Muji exited Indonesia on 21st March 2023 as they stated in their official Instagram page.

- Buyer profile – Low threat

Miniso’s customers are considered ‘risk avoidant’, because Miniso’s products are basic household items or niche accessories, making Miniso’s products as low-risk purchases.

- Performance trends – Low threat

Miniso has shown an upward trend in its revenue and profit. For the quarter ending March 31, 2023, Miniso reported a revenue of approximately USD 430.2 million, which numbered a 26.2% increase consecutively. Revenue from China also indicates growth by 18.1%, and 54.6% increase for overseas markets, compared to the same period in 2022 (MINISO InvestorRoom).

Threats :

While there aren’t any business-threatening issues that are urgent for Miniso, Miniso can’t be unconcerned. Substitutes such as MUJI and IKEA offers products that are marketed as sustainable and eco-friendly unlike Miniso. Certain customers that are concerned about sustainability, might consider buying products from other brands besides Miniso.

Opportunities :

Miniso can leverage their market by trying to expand into newer categories like sustainable goods. Nowadays, customers are much more aware, they commonly ask questions like “Where is this product from ?” or “Is this product made sustainably ?”. So having more sustainable options in Miniso stores could help further grow their market.

References

- https://muji.in/product/right-angle-arch-support-sneaker-socks-pack-of-2-10591769

- https://miniso.pk/products/daisy-minions-collection-ankle-sockspink?srsltid=AfmBOopMJOsd1qlOj-oGw5ApzLhOheDYs-Rue2g-kg62ZjEcm69w0-PU

https://craft.co/miniso/competitors - https://www.instagram.com/p/CM_tsVfg8wB/?utm_source=ig_web_copy_link&igsh=MzRlODBiNWFlZA==

- MINISO InvestorRoom