Financial Technology (Part 5)

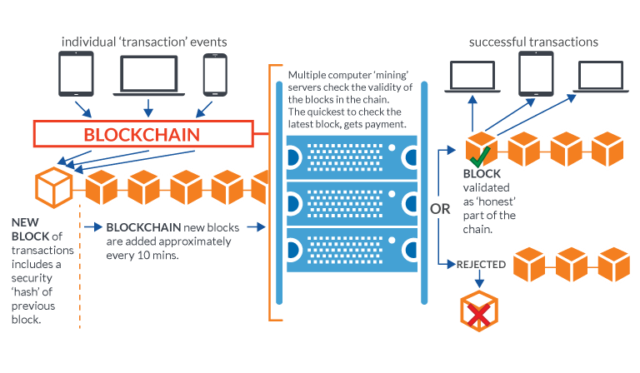

Spendific is an application that connect to a user’s bank account and, after taking into account all of their outgoings, states what is left to spend. Generation Z will only ever know “mobile”, it should come as no surprise that this is and will continue to be the case. Smart wearables, specifically technologically advanced financial apps and an increase in mobile payment opportunities, are the result of consumer demand. Blockchain (the technology on which bitcoin is based) is a distributed data store that holds a public ledger of transactions for crypto currencies, such as bitcoin itself.

Tech start-ups look at this financial services landscape and using rationality of the internet, see poor customer service and room for tremendous efficiencies. The same logic has been applied in other industries such as music and telecommunications, which have also been completely transformed by the power of new technologies and the internet.

Both FinTech players and banks have much to gain from working together.

The growth of FinTech and push for open access to financial data has been noted industry wide as the government continues its support of FinTech firms and the development of the UK as the world’s most exciting financial hub.

There’s much to gain from FinTech firms and traditional banks embarking on a collaborative relationship to discover and define the future growth potential within industry.

Each FinTech, each service, each level, and each geography has its own set of rules and you must implement strategy for how you might use regulation to your advantage at every stage of your FinTech’s expansion and development. Even something as simple as regulation in a specific geography must be carefully considered. If you have got multi-million or billion dollar for a global business, you may have the funds to bye any device that you may need from local or global consultant firms. Regardless of any purchased advice or great partnership, please keep in mind that you will never be able to outsource or delegate regulatory compliance. If compliance becomes part of your company, your life, and your DNA, it will be one of your key success factor.